Pellet production in Germany

Nowadays the German pellet market is in its infancy and needs an introduction of some measures contributing to the disappearance of difficulties on the way of the industry.Wood pellets are produced from woody biomass, obtained from two main industries: wood processing and wood converting industry. Percentage ratio of these two sources is almost equal, but still there is a shift towards wood processing industry, which covers 55% (1.45 million dry tons), where 52.5% belongs to the sawmill industry and 2.5% to the others. Wood converting industry, correspondingly, covers the rest 45% (1.18 million dry tons).

As concerns pellet producers, principal part of them are located in Southern Germany, but the possibility to situate some plants in the north not far from big sawmills is also a subject of deep concern. To such pellet producing factories can be referred German Pellets, established in Wismar in 2005, with production volumes about 60,000 tonnes and a factory, set up in Schwedt in 2006, producing 100,000 tonnes.

As soon as the German pellet market is young, it faces some obstacles. The most significant of them are the inappropriate supply chain and the poor marketing of pellets and combustion systems. Hereby, Nothern Germany needs to solve the problem of complicated intensification of combustion systems due to insufficient pellets supply. Such market barrier as the increasing competition with material usage is also should be mentioned because industry byproducts (sawdust) are the main sources for pellets production.

The use of solid biofuel for small-scale combustion systems has been constantly rising during several last years. So, the strengthening of pellet production industry is followed by the development of pellet fuelled small-scale combustion systems.

According to the estimates there are about 9 million solid fuel heating systems are set in German households today. However, despite the great number of small-scale heating systems, their use is too far from being called an effective one. Generally they situated in single- and two-family homes, and fireplaces, chimneys and tiled stoves are working from time to time.

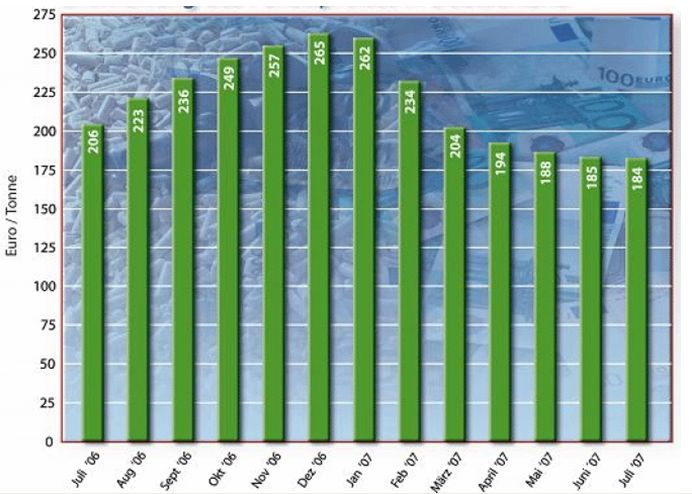

Simultaneously with the growth of wood pellets popularity their price was also moving ahead. And although its level was relatively stable and low until 2005, during the next year the price has suffered enormous boost, what is shown on a diagram below.

Studying this period of time (July 2006 – July 2007) it is obviously seen that the price was significantly low and the demand was weak despite the great jump in December 2006. The lowering of price and demand was provoked by several factors: sharpening of the concern with particle emissions and reduction of subsidies for combustion systems for households. All this brought to uncertainty of both pellets suppliers and combustion systems suppliers and gaining by them of low incomes.

Producers of wood pellets are also face the problem of product delivery, what can be achieved in two ways: to have own transport facilities or take services of partner distributors.

The two examples, mentioned below, clearly show how it works on practice.

1) The German wood energy centre Olsberg (North Rhine-Westphalia), consortium of forest owners, saw mills, one pellet boiler company and the city Olsberg, produces and delivers own wood pellets from stock to households in 15 kg bags, big bags (1 t) or by tank lorries. The company delivers its products to nearby areas as well as to other parts of North Rhine-Westphalia, Lower Saxony and Hesse.

2) Westerwalder Holzpellets GmbH only produces pellets and does not have any silo vehicles. So, the transportation of the product is made by partner distributors, mostly regional traders, themselves.